is wyoming a tax free state

In 2022 Connecticut added another bonus tax-free week in April. Code of Vt.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

On the other end of the spectrum is Louisiana whose combined state and local sales tax weighs in at 955 percent.

. Sales Tax Avoidance. The lowest state and local sales taxes after Alaskas are in Hawaii 444 percent Wyoming 536 percent Wisconsin 543 percent and Maine 55 percent. 6783 centsgallon Includes all taxes Cigarette Tax.

Whether or not your property generates income you are committed to. Access Membership offers free benefits for job seekers including priority messaging a searchable resume option a salary checker tool and many more. Furthermore you pay state income taxes where the money is made.

Cities and counties may add up to 4875 in additional sales tax. Start filing your tax return now. TAX DAY NOW MAY 17th - There are -473 days left until taxes are due.

Connecticut switched up tax-free week for 2022 and now offers two of them. Safety Improvement Fund Safety Improvement FundLet us help you make your business safe. NEW YORK Sales Taxes.

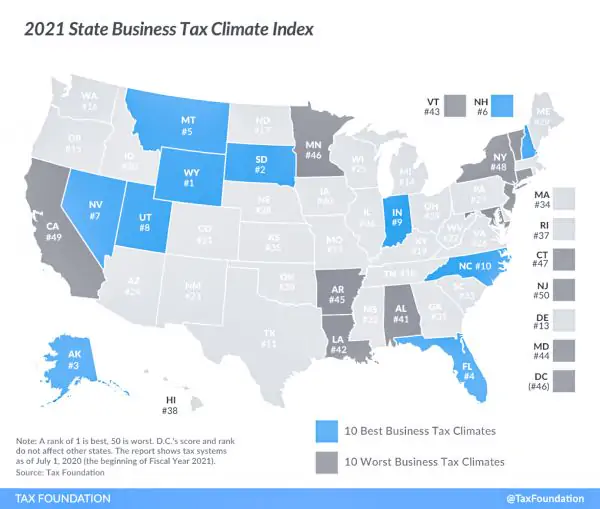

Even if there are applicable tax advantages in Wyoming this wont apply if youre doing business in your home state. Basically this is an annual tax imposed by your municipal authorities based on the value of your property. The Equality State also has the added benefit of being one of seven states with no state income tax.

Detailed Wyoming state income tax rates and brackets are available on this page. So that fact that Wyoming doesnt have state corporate income tax doesnt matter. Nine states Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have no income taxes.

You can use our free Wyoming income tax calculator to get a good estimate of what your tax liability will be come. Rules 19707-1 requires resellers to register with the state in order to purchase goods tax-free. Online Free Federal Tax Lien Search By Name.

If you need a copy of your tax return the fee is nominal and it can be mailed to you. Not where the LLC is formed. Combined with the state sales tax the highest sales tax rate in Wyoming is 6 in the cities of Cheyenne Laramie Sheridan Casper and Jackson and 72 other cities.

Does Virginia require registration with the state for a resale certificate. Click here for a larger sales tax map or here for a sales tax table. In 2019 the resolution passed through the state House on a 37-20 vote but was rejected by the Senate corporations committee.

The original one the annual tax-free week still runs in August the third Sunday through the following Saturday. April 10April 16 AND Aug. South Dakota and Wyoming do not have state corporate income taxes at all.

Are you looking for an attorney but you cant afford their full fees. 40 food prescription and over-the-counter drugs exempt. Keep in mind that some states have both corporate income tax and gross receipts tax.

Taxes are paid where the money is made. The New Jersey income tax rate for tax year 2021 is progressive from a low of 14 to a high of 1075. Market your products and services to every lawyer licensed in Wyoming.

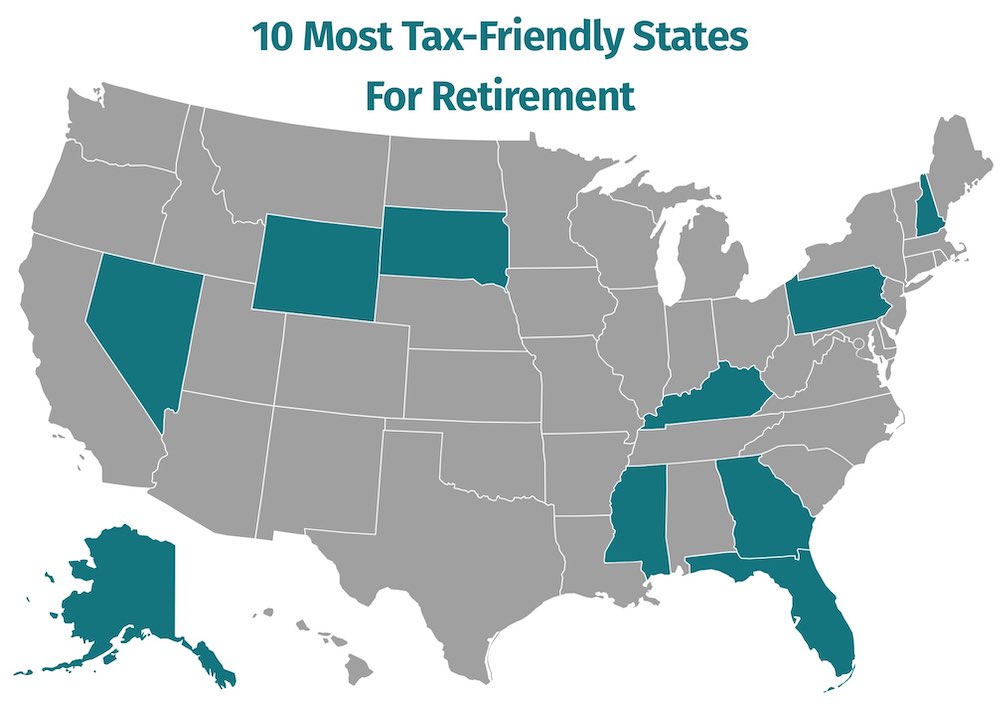

Printable New Jersey state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Connecticut Tax-Free Weekend. For retirees that can mean no state tax on Social Security benefits pensions and other sources of retirement income.

In order to obtain a free federal tax lien search you can contact the IRS and see if theyll send you an electronic copy. A Property tax is also known as Real Estate Tax or House Tax. Wyoming OSHA Wyoming OSHALearn how to make your business safe for everyone.

The Tax Foundation puts the states total tax burden at 98 percent making it the 24th most affordable state the least of any state with no income tax and behind other areas that do charge the. Many times theyll charge a nominal fee for a certified copy. One possible way to save money is to move to a state with no income tax.

There are a total of 106 local tax jurisdictions across the state collecting an average local tax of 1436. 6152 centsgallon Includes all taxes Diesel Fuel Tax. In 2016 Wyoming Promise attempted to bring a similar resolution before the voters and gathered more than 20000 signatures falling short of requirements to put the issue on the Wyoming ballot.

A gross receipts tax is a tax on a businesss gross receipts which includes the businesss total revenue without deductions eg operating expenses. The state income tax table can be found inside the New Jersey 1040 instructions booklet. Delaware used to advertise on its highway welcome sign that it was the Home of Tax-Free Shopping State and municipal governments should be wary of raising rates too high in comparison to their neighbors because this will result in lower revenue or in extreme circumstances revenue losses.

The State of Wyoming is the perfect place for you. New York City adds 150 Personal Income Taxes. Rules 197015-3 contains the exception for drop shippers to be required to be registered with the state.

Unemployment Insurance Unemployment InsuranceLet us assist you with all unemployment insurance and tax concerns.

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Should You Move To A State With No Income Tax Forbes Advisor

Wyoming Wy State Income Tax Information

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Precious Metals Sales Tax Rules Regulations By State Buy Gold And Silver Coins Bgasc Com

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

Top 10 Most Tax Friendly States For Retirement 2021

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

9 Us States That Don T Charge State Income Taxes

States With No Income Tax H R Block

Wyoming Income Tax Calculator Smartasset

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes